Have you been hearing about a coin shortage recently?

Coin shortages are nothing new.

In fact, the United States has experienced a shortage of coins on many occasions since the 1790s — during the earliest days of the U.S. Mint.

Following is everything you want to know about U.S. coin shortages, including:

- What a coin shortage is

- How and why coin shortages happen

- Who a coin shortage affects the most (both directly and indirectly)

- What a coin shortage in the U.S. really means

What Exactly Is A Coin Shortage?

In its most basic sense, a coin shortage means there aren’t enough coins in circulation to support economic demand.

This doesn’t necessarily mean there aren’t enough coins in existence.

Nor does this always mean the U.S. Mint isn’t producing enough coins to meet demand.

What Causes A Coin Shortage?

A coin shortage can be caused by a variety of factors, including:

- Rising bullion prices

- Coin production shortfalls at the U.S. Mint

- A national crisis (such as a war or pandemic)

Let’s look at the causes behind the most drastic coin shortages in the United States…

5 Previous U.S. Coin Shortages Explained

#1 – The 2020-2021 U.S. Coin Shortage

Some may think that a coin shortage is sort of an outdated concept — especially in an era when many, if not most, people use plastic cards and phone apps to pay for goods and services.

But this is hardly true at all.

Take, for example, the massive coin shortage that began during the spring of 2020 — when people were using credit cards and apps to pay for seemingly everything.

The 2020 and 2021 coin shortage was caused, in part:

- When the U.S. Mint reduced staffing and production for several weeks during the height of the COVID-19 pandemic (spring 2020).

- Shipments of coins to banks and stores were limited.

- People weren’t spending coins in circulation — due to lockdowns, closures of stores and businesses, and a general reluctance of people to be out and about for much of spring and summer 2021.

Even after the U.S. Mint finally came back online at full production levels over the summer of 2020, it still took time to eliminate the backlog of coin shipments from the U.S. Mint to banks and businesses. Pocket change remained scarce for many months.

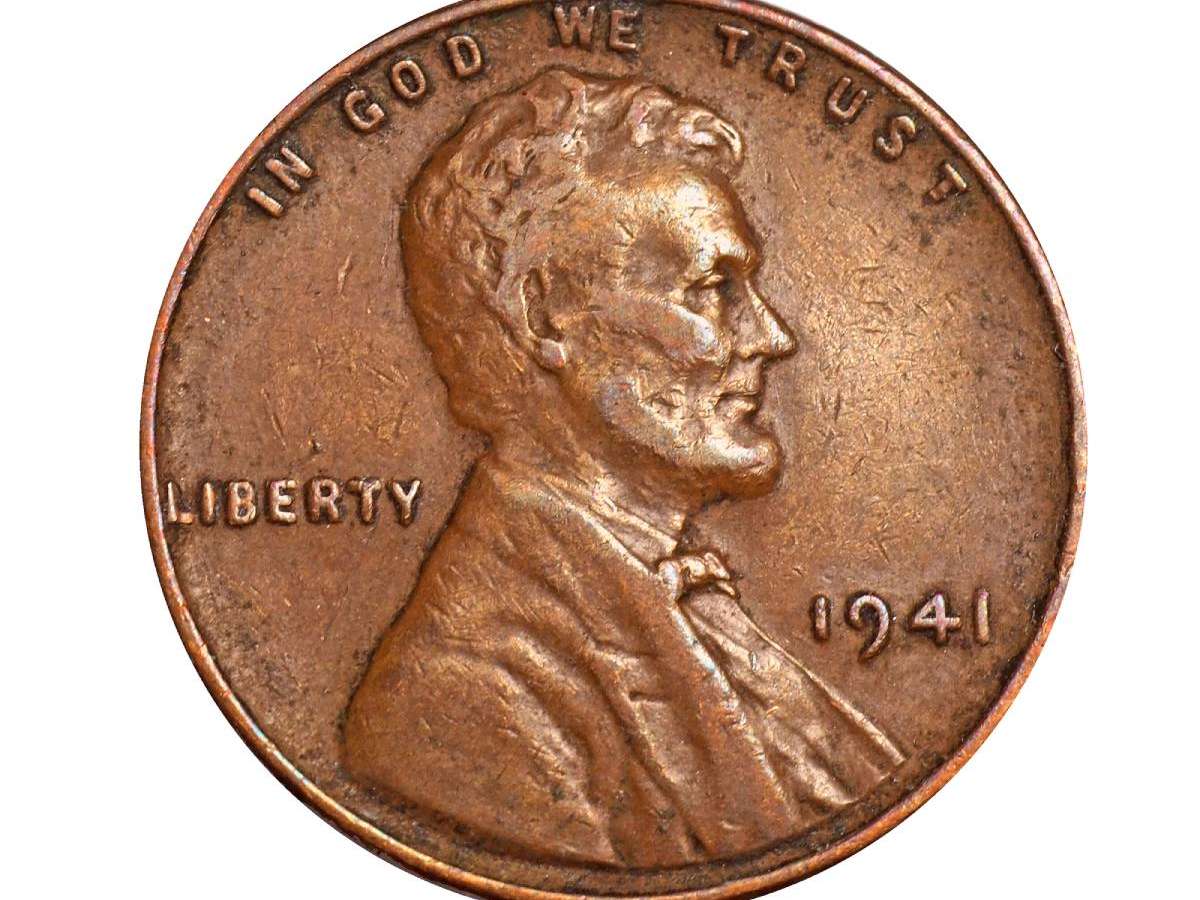

#2 – The U.S. Penny Shortage Of The 1970s

If you’ve got a 5-gallon bucket half-filled with pennies at home like so many people do, then you probably won’t believe there was a penny shortage in the U.S. during the 1970s. But there was!

Copper prices began rising in the early 1970s, causing people to hoard copper pennies due to their potential value above face. The U.S. Mint increased penny production, but this only lent to more pennies for people to hoard. There came a point where the 1970s penny shortage became so critical that businesses started offering slight discounts for those who spent pennies to buy goods and services.

The U.S. Mint began experimenting with cheaper metal alternatives for the penny — including aluminum.

Copper prices started coming down, just as the government was about to release 1974 aluminum pennies into circulation. These were never officially released. However, some people who find a 1974 silver penny (as it’s often referred to) think they’ve found a rare 1974 aluminum penny — which is generally illegal to own.

Copper prices were heading back up by the end of the 1970s, prompting the U.S. government to consider a new metallic composition for the penny in 1981. Congress approved a copper-coated zinc composition that went into use in 1982 — making copper pennies for circulation obsolete.

#3 – The Great Silver Coin Shortage Of The 1960s

A U.S. coin shortage in the early 1960s was mainly caused by rising silver prices — which prompted silver stackers to pull silver dimes, quarters, and half dollars from circulation by the millions upon millions.

With fewer high-denomination coins in circulation, there weren’t enough coins floating around to support the needs of commerce. This became an especially big problem — due to the fact that credit cards were a new concept and most people still used cash to make even large purchases.

The U.S. Mint began making copper-nickel dimes and quarters in 1965, and these were churned out by the billions during the mid-1960s. By the end of the decade, the coin shortage was little more than a bad memory.

However, the coin shortage had become so bad that the U.S. Mint temporarily halted the use of mintmarks on coins (to mitigate collecting activity) and stopped making regular proof sets and mint sets for coin collectors.

As a result, no U.S. coins dated 1965 through 1967 have any mintmarks.

Mint marks on coins returned in 1968, along with proof sets and mint sets.

#4 – The U.S. Civil War Coin Shortage

Things got so bad with a shortage of small coins during the United States Civil War (from 1861 through 1865) that private merchants and local governments began issuing their own currency in the form of tokens that could be exchanged for goods and services.

The U.S. Mint struck a 2-cent coin beginning in 1864 and a 3-cent nickel the following year in 1865.

The mint also eventually increased coin production to help eliminate the massive Civil War coin shortage.

Thousands of different tokens were made by private individuals and local governments during the early and mid-1860s — and these are highly collectible today!

#5 – The U.S. Coin Shortage Of The 1790s And Early 1800s

One of the first coin shortages in the United States occurred during the late 1790s and early 1800s — when the fledgling United States Mint, founded in 1792, was trying to produce a large-enough baseline of federal coinage to satisfy the growing commerce needs of a young and expanding nation.

At the time, foreign coins were considered legal tender and they circulated alongside the relatively few U.S. Mint coins that had been produced at that time. These pieces also comingled with privately minted tokens and monies made by local governments.

Exacerbating the problem was a short supply of copper planchets for minting half cents and pennies and a shortage of smaller-denomination silver coinage — since most people who deposited silver at the mint preferred receiving their bullion in the form of silver dollars.

Who Does A Coin Shortage Affect (Directly And Indirectly)?

Coin shortages affect almost everyone.

Coin shortages severely affect people who use cash for their purchases. (Millions of people don’t use credit or debit cards at all, nor do they use payment apps to buy things.)

Even people who prefer to use plastic cards or apps to pay for things may find they’re paying more than they have to during a coin shortage — because many businesses offer slight cash discounts to those willing to pay for goods or services with coins. (And those who do use coins and cash for payments during a coin shortage generally have to use exact change — because the business might be unable to give change in return.)

Many businesses are directly impacted by coin shortages — because they’re not able to conduct business as usual when they’re dependent on cash. Think of all the restaurants that run on a cash-only basis. And don’t forget banks… Imagine trying to run a bank during a coin shortage!

How You Can Help End A Coin Shortage

Even though a coin shortage can seem like something big and out of your control, you can actually play a role in helping the nation end a current coin shortage and prevent one in the future.

The way you can do this is by spending the coins you already have.

Have a coin jar? A piggy bank? A sock full of coins?…

Before spending those coins, make sure you check them and pull out all coins worth more than face value.

Then:

- Spend them at your local convenience stores and restaurants.

- Place them in tip jars that you find near cash registers.

- Convert them for cash or redeemable vouchers through a coin counting machine.

- Deposit them at your bank.

If we all spent the coins that we’re storing in our homes, we could help to put an end to coin shortages in the U.S. — and prevent future coin shortages from happening.

I’m the Coin Editor here at TheFunTimesGuide. My love for coins began when I was 11 years old. I primarily collect and study U.S. coins produced during the 20th century.

I’m a member of the American Numismatic Association (ANA) and the Numismatic Literary Guild (NLG) and have won multiple awards from the NLG for my work as a coin journalist. I’m also the editor at the Florida United Numismatists Club (FUN Topics magazine), and author of Images of America: The United States Mint in Philadelphia (a book that explores the colorful history of the Philadelphia Mint). I’ve contributed hundreds of articles for various coin publications including COINage, The Numismatist, Numismatic News, Coin Dealer Newsletter, Coin Values, and CoinWeek.

I’ve authored nearly 1,000 articles here at The Fun Times Guide to Coins (many of them with over 50K shares), and I welcome your coin questions in the comments below!