American Silver Eagle coins are widely regarded as bullion investment coins for those who wish to make money buying and selling the popular 1-ounce silver coins.

Even though I’m a dyed-in-the-wool numismatist, I like collecting silver bullion eagles.

Some penny-pinching silver stackers probably can’t fathom the idea of collecting each and every silver eagle made since 1986 — because many cost much more to buy than their silver spot price. But it’s pretty hard to resist putting together a set of these beautiful silver coins.

The Joys Of Collecting American Silver Eagle Coins

There are many reasons I love American Silver Eagles, or as some call them in bullion shorthand, “ASEs.”

Let me share with you my top 3 reasons for collecting Silver Eagle dollar coins:

#1 – Silver Eagles Are Beautiful Coins

If the American Silver Eagle looks somewhat familiar to you, then you’ve got a keen eye indeed.

The obverse design of the silver eagle features the same Walking Liberty motif that once appeared on the half dollar early in the 20th century.

Adolph A. Weinman was a celebrated artist who designed the Walking Liberty half dollar — which was made from 1916 through 1947 and is considered one of the most beautiful silver coins the United States Mint has ever made.

The design was so popular with collectors that when the American Silver Eagle dollar coin was formally introduced in 1986, it was decided that Weinman’s design would be reprised for the new bullion coin.

United States Mint sculptor-engraver John Mercanti helped touch up the Walking Liberty motif for the obverse of the silver eagle and designed a heraldic eagle reverse for the bullion piece.

The American Silver Eagle design has remained virtually untouched since 1986, and the coin remains one of the most popular silver bullion issues in the world.

#2 – American Silver Eagle Dollar Coins Are Relatively Common

While you won’t be finding American Silver Eagles in circulation, that doesn’t mean they’re rare coins!

In fact, some 400 million silver eagles were made during the first 30 years of the American Silver Eagle program — and annual production records since about 2010 have been falling almost each successive year.

During most of the first 20 years of the series, production figures for the silver eagles hovered between 5 million and 10 million silver eagle coins annually, with a few exceptions.

Generally speaking, large bullion dealers who offer their customers a choice of dates will have a good variety of coins on hand with an excellent representation of different years.

This doesn’t necessarily mean that any one dealer will have the specific dates you’re looking for. But because ASEs have been made in plentiful supply, you should have success if you look to another coin dealer for the dates you need for your collection.

#3 – American Silver Eagle Coins Are Easy To Sell

It might be difficult to find someone who will pay big bucks for your rolls of common Lincoln wheat pennies or offer oodles of cash for a set of cleaned, dateless Buffalo nickels, but I can promise you’ll almost always find a buyer who will take silver eagles off your hands.

Silver bullion coins are in demand, pure and simple. There’s always someone who will buy silver.

Whether the market is up or down, there are people who will pay the going rate to add silver coins like American Silver Eagles to their personal collections, investment portfolios, or dealer inventories.

While the American Silver Eagle dollar coin has its broadest audience in the United States, there are millions of international investors and collectors who would love to add these silver coins to their holdings, too.

It’s therefore relatively easy to find willing buyers overseas.

But what’s the fuss around silver anyway and why are American Silver coins so popular among investors?

Here are some thoughts:

- Silver is a commodity that is used in jewelry, photography, manufacturing, medicine, and more.

- As an in-demand metal, silver prices tend to rise and fall with the whims and pressures of world bullion markets.

- The metal is considerably scarce in comparison to its demand and known available supply.

- Silver is a precious metal that has had value for many centuries — its allure simply isn’t going away!

The Challenges Of Collecting American Silver Eagle Coins

As much as I enjoy ASEs, they aren’t necessarily the easiest coins to collect. There are a few pitfalls that I’ve found come with collecting American Silver Eagles dollar coins.

Here are 3 of the drawbacks that come with collecting silver eagle coins:

#1 – Fluctuating Silver Bullion Prices

As bullion investors know, it’s not always easy to predict what silver prices are going to do — which makes it extremely difficult to buy American Silver Eagle dollar coins and know well in advance what they’ll cost.

Generally, your best bet is to buy silver eagles when silver prices appear to be relatively low. And, if you want to unload the coins, sell them when bullion values are at higher levels.

While some investment experts claim to know what silver might be worth 1 day, 1 week, 1 month, or even 1 year or more down the road, there’s no way to really know. Nobody has a crystal ball, and it’s impossible to foresee a tragic world event or significant market situation that could send silver prices through the roof or cause them to plummet overnight.

If anybody who poses as an expert tells you “silver’s gonna be worth $50 an ounce in 5 years,” or something like that, run the other way as quickly as possible.

Urgent-sounding predictions about silver (or gold) prices like that are simply devised to sell bullion coins to you today — besides, no legitimate coin or bullion dealer can or will make claims about what anything will be worth even one moment into the future.

Again, there’s absolutely no way to predict what silver bullion prices will be at any point beyond this moment. Period.

#2 – Scarce Dates Are Expensive

Many silver stackers will do just about anything to shave even just a few cents per coin off the cost of a transaction.

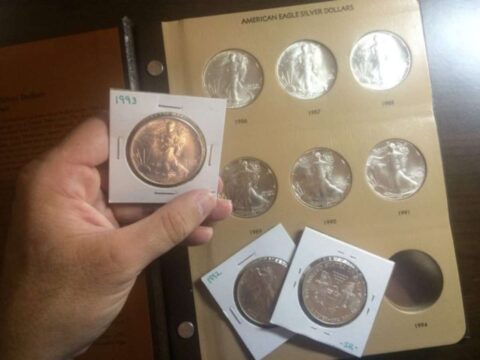

That’s why few silver collectors would ever consider buying a 1996 American Silver Eagle — a $70 coin that is regarded as a key date among silver eagles.

Here’s the difference between key date, semi-key date, and better date coins.

Why is the 1996 silver eagle so expensive?

Because only 3,603,386 were made — a figure that pales in comparison to the 10 million+ made during many other years.

In fact, all 1980s and 1990s silver eagles are worth as much as double over silver spot value due to their relative scarcity on the market.

No, this doesn’t strike a paradox to my earlier point about American Silver Eagles being “common” — you best believe they are! But some dates are simply “more common” than others.

What’s the rarest regular-issue, non-die variety American Silver Eagle?

It’s the 1995-W (West Point Mint) silver eagle. Only 30,125 were made for inclusion in a special American Eagle 10th Anniversary set, and those pieces trade for more than $4,000 — yes, you read that correctly!

#3 – There’s A Gap That Can’t Be Filled For 2009 Proof Silver Eagles

If you prefer collecting proof American Silver Eagles over bullion or uncirculated quality specimens, you’ll find it totally impossible to fill the 2009 gap in your proof silver eagle collection.

That’s because no proof silver eagles were struck in 2009.

Presumably, there would have been a 2009-W proof silver eagle, but the likelihood of that coming to fruition looked pretty dim as early as summer 2008.

That’s when the U.S. Mint abruptly stopped selling 2008 proof silver eagles when high demand for bullion specimens caused Mint officials to switch gears altogether and focus attention on making the coins for investors.

While the move may have seemed unfair to some coin collectors, Public Law 99-61 requires the Mint to allocate silver eagle blanks, or planchets, for public demand first — which means bullion specimens take precedent over collector versions such as proofs.

The demand for bullion silver eagles in 2008 spilled into 2009, and the Mint was simply unable to strike any silver eagle proofs in 2009.

It’s an unfortunate situation for collectors — because 2009 is so far the only year in the American Silver Eagle series during which proofs were not made.

My latest video reveals the Top 10 rare & valuable American Silver Eagles:

More Info About American Silver Eagle Dollar Coins

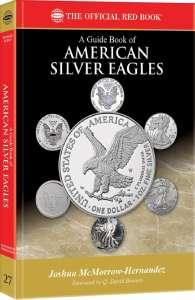

If you collect or invest in American Silver Eagles, you might enjoy my latest book –

A Guide Book of American Silver Eagles

(Whitman Publishing).