United States silver eagles are 1-ounce silver bullion coins that are usually bought, sold, and traded for a price very close to the current metal value.

The first $1 silver eagles are dated 1986 and have been a regular U.S. Mint release since then.

The obverse of the American Silver Eagle may look familiar to seasoned coin collectors. It’s none other than the widely declared most beautiful design ever placed on a coin — Adolph A. Weinman’s Walking Liberty — which graced the U.S. half dollar from 1916 to 1947.

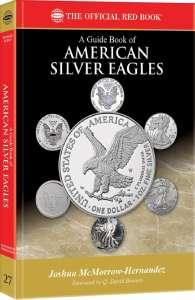

If you collect or invest in American Silver Eagles, you might enjoy my latest book –

A Guide Book of American Silver Eagles

(Whitman Publishing).

My latest video reveals the Top 10 rare & valuable American Silver Eagles:

Collecting Silver Eagle Coins

American Silver Eagle dollar coins are struck in both uncirculated and proof formats and are sold by the U.S. Mint and private coin dealers.

As bullion coins, silver eagles are extremely popular among investors — because prices fluctuate very closely with prevailing silver prices. Just as silver prices have risen in recent years, so have the values of Silver Eagle bullion coins.

Uncirculated silver eagles are generally less expensive than proof versions and are often favored by investors — because their values are much closer to the relative bullion value.

Proof versions of American Silver Eagle coins, while also popular with investors, have a large following among coin collectors.

Some proof issues are relatively scarce, and demand high premiums over the prices of uncirculated specimens from the same year.

Here’s my list of the joys and challenges of collecting American silver eagles.

Scarce American Silver Eagle Coin Values

While most silver eagles (especially uncirculated examples) are highly common, there are some scarce dates.

Following are some of the scarce uncirculated and proof dates in the Silver Eagle series. Prices for these dates tend to follow collector demand, rather than direct silver bullion fluctuations:

- 1996 Silver Eagle: $57 to $110 in Mint State-63 through Mint State-69

- 2006-W Silver Eagle: $50 to $575 in Mint State-63 through Mint State-70

- 2006-W 20th Anniversary Silver Eagle: $65 to $2,000 in Mint State-63 through Mint State-70

- 2006-W 20th Anniversary First Strike Silver Eagle: $90 to $3,250 in Mint State-63 through Mint State-70

- 2008-W Reverse of 2007 $1 Silver Eagle: $375 to $2,100 in Mint State-63 through Mint State-70

- 2008-W Reverse of 2007 First Strike Silver Eagle: $430 to $2,500 in Mint State-63 through Mint State-70

- 1993-P DCAM Proof Silver Eagle: $100 to $4,500 in Proof-63 through Proof-70

- 1994-P DCAM Proof Silver Eagle: $175 to $3,000 in Proof-63 through Proof-70

- 1995-P DCAM Proof Silver Eagle: $127 to $1,300 in Proof-63 through Proof-70

- 1995-W DCAM Proof Silver Eagle: $3,700 to $35,000 in Proof-63 through Proof-70

- 1996-P DCAM Proof Silver Eagle: $80 to $1,200 in Proof-63 through Proof-70

- 1997-P DCAM Proof Silver Eagle: $80 to $1,275 in Proof-62 through Proof-70

- 2006-P 20th Anniversary DCAM Proof Silver Eagle: $170 to $650 in Proof-63 through Proof-70

- 2006-P Reverse of 20th Anniversary DCAM Proof Silver Eagle: $180 to $1,200 in Proof 63 through Proof-70

*”W” is the mint mark for West Point, New York. DCAM is the widely used acronym for Deep Cameo Proof, or a coin with frosted images and mirror-like backgrounds (also called fields).

To find the current American Silver Eagle dollar value, check out the Professional Coin Grading Service’s Silver Eagle price guide.

Grading Silver Eagle Coins

Many American Silver Eagle dollar coins have been slabbed by grading services. These silver eagles normally receive grades of Mint-State 67 or Proof-67 and higher.

If you are purchasing American silver eagles for bullion investment, you’re probably best buying typical-quality uncirculated Silver Eagle coins.

Typical, uncirculated American silver eagles in grades Mint State-60 through Mint State-63 are those which cost the closest to the silver bullion price (aside from any worn or impaired silver eagles you may find on the market).

Slabbed high-grade examples and proof Silver Eagle dollar coins (which are highly desirable collector coins) cost far more than average uncirculated silver eagles. It’s fair to say that most high-grade silver eagles and proof silver eagles are priced according to the coin collector and investor market, rather than the bullion market.

Prices for American Silver Eagle dollar coins can fluctuate daily. To find current silver values, check out a site like APMEX , which has up-to-date bullion values.

Where To Buy The American Silver Eagle Dollar Coin

Most coin dealers sell both uncirculated and proof versions of silver eagles.

There are also many bullion brokers who sell and help facilitate the sale of Silver Eagle dollar coins.

Uncirculated and proof versions of current American Silver Eagle coins are available on the U.S. Mint’s site, as well.