When the United States Mint began selling American Silver Eagles in 1986, a new era in American numismatics and investing was born.

Other nations — like Canada and South Africa — had already been in the business of making bullion coinage for its citizens by the mid-1980s.

However, the United States’ bullion program (which originally included gold and silver; it later added platinum and palladium coins too) started a buying frenzy — not only among hardcore investors but also numismatists, who appreciate the classic designs on the American Eagle coins.

Facts About American Silver Eagles

The American Silver Eagle is the final product of our nation’s decision to sell some of the silver from our government stockpile.

The Liberty Coin Act, which authorizes the production of American Silver Eagles, was signed by President Ronald Reagan in 1985.

The obverse of the American Silver Eagle features the Walking Liberty motif — which first appeared to widespread acclaim on the half dollar in 1916. Walking Liberty half dollars were designed by Adolph Weinman and were widely popular, lasting in production until 1947. After 39 years in retirement, the Walking Liberty design was stunningly recreated on the American Silver Eagle in 1986.

On the reverse of the American Silver Eagle is a depiction of a heraldic eagle holding a shield, a motif designed by John Mercanti. Below the eagle are the words 1 OZ. FINE SILVER ~ ONE DOLLAR.

American Silver Eagles are minted in 2 varieties:

- Proof American Silver Eagles — sell for premiums well above silver spot, making them more appealing to collectors.

- Uncirculated (bullion-quality) American Silver Eagles — are also enjoyed by many collectors but by far have their biggest following among silver investors.

Reasons To Invest In American Silver Eagles

It’s safe to say that millions of American Silver Eagles have found their way into investment portfolios since the 1980s.

Part of the reason American Silver Eagles are so popular as investments — aside from their virtually pure silver content — is that they’re allowed to be included in Individual Retirement Accounts (IRAs).

Something else American Silver Eagles have going for them is their recognition all over the globe as government-backed silver bullion coins.

Also, American Silver Eagles are legal tender. With a face value of $1 (which is actually well below their bullion value as silver coins), an American Silver Eagle coin can be used as money in an emergency.

Most American Silver Eagles are pretty common and in bullion-quality are available for little above melt.

Does paying a higher premium for U.S. Silver Eagles make sense, instead of buying generic silver rounds?

Reasons To Collect American Silver Eagles

American Silver Eagles are also loved by numismatists and others who collect coins.

While the coin’s famous Walking Liberty design may be the primary motivation among those who collect American Silver Eagles, the silver content is certainly another lure.

Plus, it’s possible to buy cheap American Silver Eagles — if you know what kinds of deals to look for.

These coins make wonderful annual additions to a coin collection:

- Proof American Silver Eagles can be bought from the United States Mint or coin dealers.

- Bullion-quality American Silver Eagles can only be purchased from coin dealers.

There are some relatively scarce American Silver Eagles worth a lot more than their bullion content. Among the most sought-after American Silver Eagles are:

- 1995-W Proof — $2,500 to $3,200+

- 1996 Uncirculated — $40 to $65+

- 2008-W Uncirculated with Reverse of the 2007 American Silver Eagle — $325 to $350+

- 2008-W Uncirculated with Reverse of the First Strike 2007 — $400 to $450+

My latest video reveals the Top 10 rare & valuable American Silver Eagles:

Collecting Bullion vs. Proof American Silver Eagles

What’s better? Proof or bullion American Silver Eagles?

That’s a tough call — it’s a decision that each collector or investor has to make on their own.

Pros & Cons Of Collecting Bullion Silver Eagles

Here are benefits of collecting bullion American Silver Eagles:

- They’re often available for only a few dollars over spot.

- They are available for all years since 1986.

- Uncirculated Silver Eagles are easy to buy and sell.

There are also some drawbacks to buying bullion Silver Eagles:

- They’re not necessarily as aesthetically pleasing as proof Silver Eagles.

- Many collectors prefer proof Silver Eagles and thus bullion pieces may be harder to sell to numismatists.

Pros & Cons Of Collecting Proof Silver Eagles

Proof Silver Eagles also come with pros and cons. Here are some pros:

- Proof American Silver Eagles are highly collectible.

- Many proof American Silver Eagles have gone up in value since their release.

- Proof Silver Eagles are easy to sell.

But there are at least a couple reasons why proof Silver Eagles aren’t ideal:

- None were made in 2009 due to a shortage of silver blanks for proof Silver Eagles, and this makes collecting a complete date run of proofs impossible.

- Proof Silver Eagles are sold at prices significantly above silver spot values, making them an impractical vehicle for profitably investing in silver.

Here’s more about the joys and challenges of collecting American Silver Eagle coins.

American Gold Eagle Coins Are Popular As Well

In addition to the American Silver Eagles, there are also American Gold Eagles, which were simultaneously introduced with their silver counterparts in 1986.

American Gold Eagles come in various options, including:

- $5 1/10-Ounce American Gold Eagle

- $10 1/4-Ounce American Gold Eagle

- $25 1/2-Ounce American Gold Eagle

- $50 1-Ounce American Gold Eagle

American Gold Eagles carry the famous Augustus Saint-Gardens obverse design first made famous on double eagles from 1907 through 1933. On the reverse of American Gold Eagles is a depiction of a family of eagles.

Gold Eagle coins are available in uncirculated and proof varieties and are popular among both collectors and investors.

Because most bullion Gold Eagles can be bought at prices relatively close to spot, they are ideal coins for bullion investors. The fact that American Gold Eagles are available in a variety of sizes helps make them popular among investors of various income levels.

In particular, the 1/10-ounce Gold Eagle with $5 denomination face value is a hit among gift givers and entry-level gold investors.

Will Platinum American Eagle Coins Be Produced Again?

Platinum American Eagle coins were first minted in 1997 — a favorite coin for tens of thousands of portfolio and IRA investors and coin collectors.

These .9995-fine coins feature an obverse design of the Statue of Liberty as imagined by engraver John Mercanti.

Platinum Eagles have been made in a variety of denominations and sizes:

- $10 1/10-Ounce Platinum Eagle

- $25 1/4-Ounce Platinum Eagle

- $50 1/2-Ounce Platinum Eagle

- $100 1-Ounce Platinum Eagle

The last of the fractional platinum coins, which weigh less than 1 ounce, were released in 2008.

Here’s everything you want to know about coin scales.

The end of these platinum coins came as demand for gold and silver Eagle coins swelled. The U.S. Mint stopped production of the uncirculated platinum coins to focus resources on gold and silver Eagle production instead.

There was speculation that the full Platinum Eagle program would resume in 2009 — though this never happened. While gold and silver Eagle coins must be minted, there are no mandated production requirements with platinum Eagles.

Other mints around the world, including the Royal Canadian Mint and Perth Mint of Australia had revived or introduced their platinum coin production in response to the unfilled demands by platinum coin investors and collectors in the United States.

Introducing Palladium Bullion Coins…

The newest kid on the bullion block is the 1-ounce American Palladium Eagle.

Released in 2017, the American Palladium Eagle features:

- On the obverse: Adolph Weinman’s Winged Liberty Head design made famous on so-called Mercury dimes struck from 1916 through 1945.

- On the reverse: Weinman’s depiction of an American eagle breaking a branch.

The coin carries a denomination of $25. Palladium Eagles are struck in uncirculated and proof finishes.

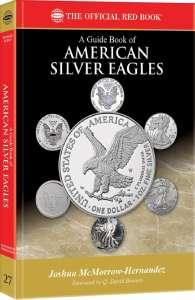

If you collect or invest in American Silver Eagles, you might enjoy my latest book –

A Guide Book of American Silver Eagles

(Whitman Publishing).