Many people want to know when gold prices will go down or go up. They want to know whether now is the time to buy gold coins… or to sell them.

Perhaps people are trying to figure out if they will make money buying gold right now.

I buy and sell gold coins from time to time for my own personal financial and collecting purposes only.

And while I’m not a gold coin dealer or gold bullion broker, I’ve been following the market long enough (since the 1990s) to offer a bit of perspective on buying and selling gold coins and gold bullion.

What I’m about to share with you isn’t investment advice, and it’s not going to tell you when you should buy or sell gold coins or gold bullion. It’s merely my reflection on what I’ve seen happen — as a coin collector, journalist, and editor — since 1992.

In this article, I will be sharing some lessons I’ve discovered about buying gold over my years as a coin collector.

You have to make your buying and selling decisions on your own. But I hope you find my thoughts at least infotaining!

When Will Gold Prices Go To $3,000 Per Ounce? $5,000 Per Ounce?

You know what’s interesting?… I’ve heard these questions for years now.

I’ve seen gold go up in price from under $300 per ounce at one point in 2002 to above $2,400 in 2024.

Gold prices seem to be trending upward over the course of time, but it’s not a linear increase. It’s not like gold prices just keep going up and up and up without periods when it goes down, down, down, too.

Case in point… Let’s look back to 1980, when gold prices were hitting what were then all-time highs of more than $800 per ounce. Within a few years, prices were hovering between only $350 and $500 per ounce, and they stayed there for a long time.

Another gold price record occurred around 2012, when the prices per ounce hovered between $1,500 and $1,900 for months. Many people thought gold was going to break the $2,000 price threshold then… and maybe even hit $3,000 per ounce.

Now get this — gold prices dropped again. There was a point in 2015 when it was south of $1,100 per ounce and many speculated it would even drop below $1,000 per ounce for the first time in years. But that didn’t happen.

Gold prices stabilized and spent a long time in the range of $1,200 to $1,500 per ounce before the COVID pandemic hit in 2020. That year, gold hit a new record high of $2,058 per ounce, causing many people to wonder when gold prices would hit $3,000 — or maybe even $5,000 per ounce.

Gold Prices Post-COVID

As COVID-era inflation set in due to rising consumer demands, product and supply-chain shortages, and other economic factors, gold investors were confident that gold prices would also go up.

They did — but not in a straight line on the chart.

Gold prices inched back down in 2021 below $2,000, and it went as low as $1,800 per ounce before things began looking brighter for gold — as it crossed the $2,000 mark again in 2022 and headed as high as $2,100 in 2023.

In 2024, gold hit more record prices, traversing the $2,200, $2,300, and even $2,400 barriers.

So, what caused the high gold prices in the mid-2020s?

Some speculate gold demand outpaced supply. Others point to political troubles in the United States and overseas. Monetary policy in the United States and around the world, along with lingering supply-chain issues from the pandemic and product demand surges also led to inflation.

What Do Future Gold Prices Hold For You?

Whether or not gold prices go up or down in price next year, or many years from now, consider the following…

I want you to remember that gold has been known to humankind for more than 5,000 years And it has been treasured by civilizations around the world.

Why?

Because it’s relatively rare, it’s beautiful, and it’s versatile. It can be used in making coins. It can be used to create amazing art. It’s also practical for industrial uses like making dentures, electronics, and even medicine.

Many claim that all of the gold ever mined could fit into a cube less than 75 feet in length on all sides.

If that’s true, then that means all the gold in the world — the gold used in every gold coin that exists right now, every piece of gold jewelry, every gold tooth, and all the gold leaf used on any church or government capital building in the world — could fit well within a typical mid-rise suburban office building. Imagine that!

So, what does this mean for you?

I believe that gold coins are worth buying for my collection. I think gold is worth investing in for my portfolio. I love this yellow metal — gold has intrinsic value.

You, too, might fare well if you buy gold coins and see their prices increase over time.

But…

Important Things To Consider When Buying Gold Coins & Bullion

Don’t get caught up in gold fever!

Here’s what I mean by that…

#1 – Don’t buy into the hype.

Just because everyone else seems to be buying gold, that doesn’t mean you have to as well. Don’t let FOMO (fear of missing out) drive your decisions, especially when it comes to buying something expensive like a car, a house, or gold. Consider your budget, and only spend money on gold if you feel you have enough.

#2 – Don’t let fear control your gold buying decisions.

Some folks use fear to sell gold. What do I mean by this? They may use scary-sounding snippets from news media or flash alarming stats to suggest the U.S. monetary system is about to crash, that fiat currency is collapsing, that all banks are on the brink of closing, or that some big political or global event is about to happen and that you need to buy gold right now. Calm down. Can I accurately predict that nothing bad is going to happen tomorrow? No… (Though I certainly hope tomorrow is a good day for all of us!) However, I can tell you that fear is not a good reason to buy gold. You know what is a good reason to buy bullion? Because you have the expendable money in the bank right now and you’re in a place to spend a small percentage of it on gold — with the hope that you will be in a better financial place if and when gold prices go up.

#3 – Don’t blow all your money on gold.

I’ve heard of some people who have cashed in their entire 401K retirement plans because they wanted to convert all their savings to gold. Oooof… Having all your eggs in one basket is never a sound investment strategy. You know what is though? Having a diversified portfolio of many different kinds of investments. This helps protect your finances so if one type of investment goes down, it won’t sink your boat. This is why spending all my money on gold scares me… Because if and when gold prices go down, I could lose a lot of money. I can’t (nor will I) tell you what percentage of your money you should spend on buying gold coins or other bullion. But I suggest you keep that percentage small enough — so if gold prices go down big time, you won’t lose your proverbial shirt in the process.

#4 – Remember, gold is NOT an investment.

Some people may think I’m crazy for saying this, but it’s true. Gold is not really an investment. It’s better to think of gold as insurance against inflation, bad economic times, and geopolitical unrest.

#5 – Beware of gold scams.

You need to avoid buying fake gold coins, and don’t get wrapped up in other bullion scams that are out there. Unfortunately, I have personally heard of way too many people who innocently bought counterfeit gold coins, fake gold bars, or got caught up in some type of fraudulent buy gold scheme. You need to protect yourself. Buy gold only from reputable dealers. And be careful if you’re looking for cheap gold coins. You can’t beat the system as a retail customer and expect to buy gold and silver coins for less than fair market value, or at least less than their spot price. You might end up getting (only) what you pay for — and I don’t mean that in a good way.

#6 – Make sure you don’t overpay for gold coins.

There’s no hard-and-fast rule about how much (or little) you should pay when you buy gold coins. When the price of gold goes up or down, bullion has a more or less fixed market trading value for a given moment in time. Yet, that’s almost never the price you’re going to pay when buying gold coins. Coin dealers have their own pricing guidelines. That means some gold coins of the exact same type and condition may cost more at one coin shop versus another at the same time. Remember, dealers have to pay for their overhead expenses and make a little profit. Know how much a gold coin is worth before you buy it — so you have a ballpark idea ahead of time on how much you should spend. Also, be sure you’re choosing the best gold and silver coins to buy for your collection or portfolio.

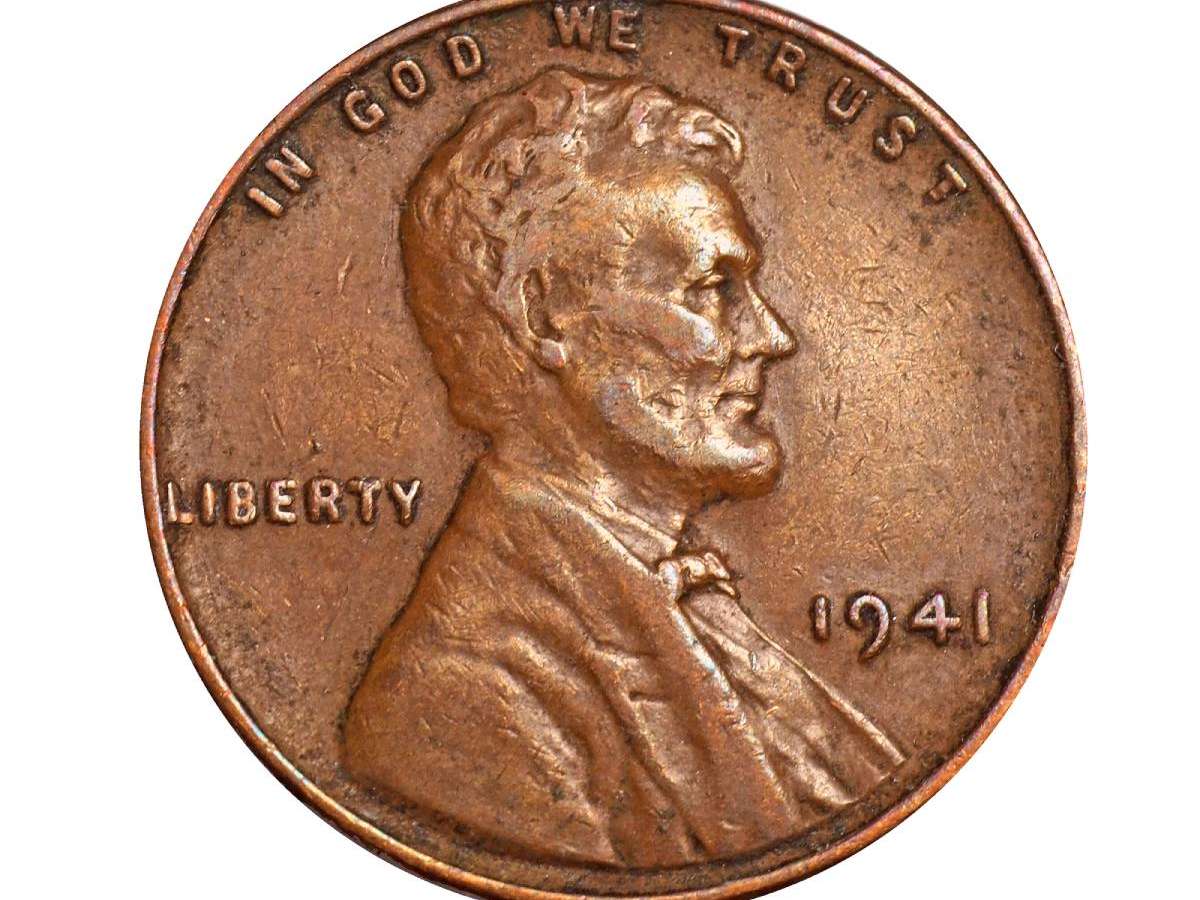

I’m the Coin Editor here at TheFunTimesGuide. My love for coins began when I was 11 years old. I primarily collect and study U.S. coins produced during the 20th century.

I’m a member of the American Numismatic Association (ANA) and the Numismatic Literary Guild (NLG) and have won multiple awards from the NLG for my work as a coin journalist. I’m also the editor at the Florida United Numismatists Club (FUN Topics magazine), and author of Images of America: The United States Mint in Philadelphia (a book that explores the colorful history of the Philadelphia Mint). I’ve contributed hundreds of articles for various coin publications including COINage, The Numismatist, Numismatic News, Coin Dealer Newsletter, Coin Values, and CoinWeek.

I’ve authored nearly 1,000 articles here at The Fun Times Guide to Coins (many of them with over 50K shares), and I welcome your coin questions in the comments below!